Posted tagged ‘NH’

October 30, 2012

For an economy struggling to gain altitude it is hard to see how the impending spending cuts and tax increases associated with the “fiscal cliff” will do anything in the short-term but bring the economy to stall speed or push it back into recession. At a time when compromise is seen as weakness and ideological impurity, an agreement must be reached in order to avoid the negative effects of the the fiscal cliff. Depending on what is included, the ‘fiscal cliff includes anywhere from $500 to $700 billion in combined spending cuts and tax increases (many via the expiration of temporary cuts).

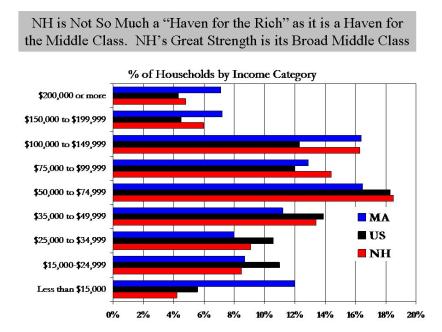

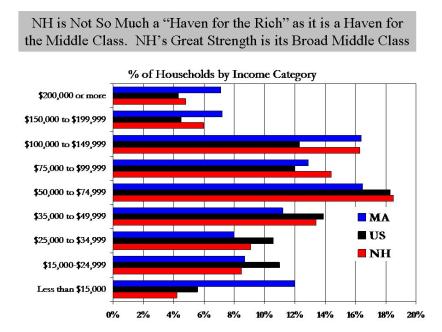

All states will feel the effects of the elimination of the temporary cut in the payroll tax but states with a higher percentage of high-income taxpayers will likely be affected more by the expiration of Bush era tax cuts. Despite often being characterized as a “tax haven” for the rich, NH is much more a “haven for the middle class” as it has a somewhat higher percentage of high-income households than the U.S. (but much lower than MA) and a relatively smaller percentage of lower- income individuals. The percentage of high-wealth individuals in NH is above the U.S. average, but the percentage of income taxes paid by those making $200,000 or more in NH is lower than 24 other states.

States where higher-wealth individuals pay a larger portion of the state’s tax burden are likely to be relatively more affected by the tax cut expiration provisions of the fiscal cliff. But NH will still see an estimated increase in payroll taxes of about $650 million, a significant drop in disposable income in the state. In addition, a study by George Mason University’s Center for Regional Analysis estimates that the defense department and non-defense department budget cuts that will result from the fiscal cliff will cost NH about 6,300 jobs and $325 million in labor income. NH no doubt will take some solace from the fact that Massachusetts is likely to see nearly 10 times the job losses from budget cuts to defense and other purposes (especially medical) and as a result of their high percentage of high-wealth households.

I want to think a reasonable resolution will be found that avoids the worst of the potential problems from the fiscal cliff. Fiscal tightening is clearly warranted, and it appears almost certain that at a minimum the payroll tax holiday will be allowed to expire as well as the Bush era tax cuts for upper income households. It is also almost certain that long term unemployment insurance benefits will be allowed to run out. After that, it all depends on one four-letter word – compromise.

Categories: Fiscal Cliff, Fiscal Policy, job growth, NH Economy, Politics

Tags: budget cuts, fiscal cliff, household income, middle class, NH, tax cuts, tax increase

Comments: 3 Comments

October 29, 2012

(My apologies for the late post – I posted this 3 hours ago but it didn’t publish so I am trying again)

PolEcon’s NH Leading Index jumped from a revised + 3.7 to +13.0 this month. its highest value since January of 2011. An Index reading of + 13.0 isn’t a signal of robust growth but it is a substantial improvement over much of the past 18 months and if it continues for another month or two it will be a clear sign of a much improved NH economy.

Weather and electricity permitting, the October edition of the Trend Lines will be emailed or available to read online at http://www.issuu.com/polecon. Seven of the nine indicators in the Index improved over the month, with initial claims for unemployment insurance showing an especially large drop. I prefer initial claims data to the unemployment rate, as it gives greater insight into the near-term direction of the labor market. I’ve stated in a prior post that I believe job growth in NH will be revised upward, based on aggregate wage and salary growth and the volume of help-wanted advertising in the state. Declining initial unemployment claims are another indicator that actual job growth is likely somewhat higher than is currently being reported (NH has seen a few negative year-over-year monthly job growth reports recently). At an average weekly number of claims at 1,400 for the month, it is still much higher than the under 1,000 number that is typically seen during periods of solid job growth, but the number continues its downward trend. The chart below shows how new claims currently compare with claims during previous periods of growth and recession. On a three-month moving average basis, the number of new claims in NH is now about what is was during the short-lived recession of the early 2000s, and compared to the first “great recession” of the early 1990s, it is also about as high now as during that difficult time. But there is also a larger population in the state and also more employment so examining initial claims as a percentage of employment in the state provides a better comparison to where the labor market stands today and where it may be heading. That comparison makes the current labor market appear to be in the early stages of recovery from recession rather than two years removed from the official end of one, but its a sign of recovery nevertheless.

Categories: Uncategorized

Tags: initial unemployment claims, job growth, New Hampshire, NH, recession, unemployment rate

Comments: Be the first to comment

October 26, 2012

Every state is obsessed with maintaining or creating a “good business climate.” I think NH has traditionally had a good business climate, with both the public and policymakers demonstrating a high regard for businesses, and with a climate of mutual respect between the business community and state policymakers. At times they have differed in their views, and the balance of interests could change marginally from time to time, but over the years there was a nice balance where each was able to ultimately rely on one another to increase opportunities and prosperity in the state. There is a lot of fretting over the business climate in the state and what it means for our ability to “attract” businesses. That is always a good thing to monitor, but I am concerned that we (business people, policy makers, citizens) may be spending too little time concerned with creating a climate that is attractive to individuals. More specifically, skilled individuals with higher levels of educational attainment that increasingly are the source of competitive economic advantage in states and regions. The in-migration of individuals with higher levels of educational attainment fueled NH’s economy and increased the concentration of technology and higher-skill industries and occupations during much of the past few decades, just as it has in other states that have been able to successfully attract skilled, well-educated individuals. The chart below shows how the educational attainment of NH residents differs between those who were born and continue to live in NH, and those who live in NH but where born in another state (in a future post I will discuss international migrants).

The chart shows that residents who have moved to NH from another state are much more likely to have a bachelor’s or higher educational degree. NH regularly loses its natives with higher-levels of educational attainment to others states, just as other states lose those individuals. Individuals with higher-levels of educational attainment are the most mobile in society. They have the most opportunities and generally resources that afford them more choices on where to locate. That means that the native population will often show overall levels of educational attainment lower than in-migrants from other states. In-migrants to MA also have much higher overall levels of educational attainment than natives who live in the state, but the native population that was born and lives in MA has higher levels of educational attainment than the native population in NH. In fact, educational attainment among those who where born and live in MA looks a lot like the in-migrant population of NH, not surprising since about 300,000 individuals born in MA now reside in NH.

In-migration to NH has been slowing and recently stopped, with tremendous implications for our economy’s ability to grow, innovate, and remain dynamic. Lets keep our eye on maintaining a good business climate (we can start by reinforcing our tradition of mutual respect between business and government), but I think we need to quickly begin asking ourselves if a singular concern about business climate is sufficient to assure growth in our economy if NH is losing its attractiveness to the individuals who are increasingly the source of its economic strength.

Categories: Demographics, Educational Attainment, migration

Tags: business climate, economic growth, educational attainment, in-migration, MA, Massachussets, NH

Comments: 1 Comment

October 24, 2012

It is hard for consumers of electricity to understand why retail prices are what they are and how they are determined. It is beyond one blog entry to fully describe the process but in overview, the suppliers of electricity (generating companies) in a region offer to supply electricity to the market at a given price and the offers are accepted beginning with the lowest cost providers first, until enough energy is supplied to meet expected demand in the region. The price of electricity offered by the last electricity generator needed to meet the regional demand determines the market price paid by companies that supply the electricity to businesses and consumers. Retail prices are a function of the market price of electricity, plus many other costs such as transmission, special infrastructure charges, and profits by suppliers, among others. Much of these costs are determined at the state level by regulators, as well as the characteristics of the retail electricity market in the state (competition) and the practices and policies of the companies that supply electricity to retail markets.

The end result is that retail prices for electricity in any state bear only a limited relationship to the cost of generating electricity in the state. The chart bellow shows that the cost to generate 1 million BTUs of electricity in New Hampshire is about in the middle of all 50 states. Vermont is also relatively low. Both states have a relatively lower generating cost per million BTUs because a significant portion of the electricity produced in their state is from nuclear generators.

The correlation between the fuel costs to generate electricity in a state and retail prices per 1 million BTUs is modest, explaining less than one-third of the price per million BTU at the retail level. The chart below show that despite fuel costs that are in the middle of the pack, NH, VT and CT have high retail prices per million BTU of electricity. The regional nature of electricity markets along with the policies of state governments and the actions of individual retail sellers of electricity all play a role in disconnect between costs for generating electricity and prices at the retail level. We don’t have much control over the supplies of electricity beyond our state but we do have some control over the mix of suppliers of electricity which determine the cost of fuel for generation and we have a lot of control of the structure of retail markets and many other factors that determine the non-generating costs of electricity in the state and ultimately prices at the retail level.

Categories: Electricity, Electricity Generation, Energy, Natural Gas, NH Economy, Oil, prices

Tags: electric generation, electricity prices, electricty, Energy, energy costs, NH

Comments: 2 Comments

October 22, 2012

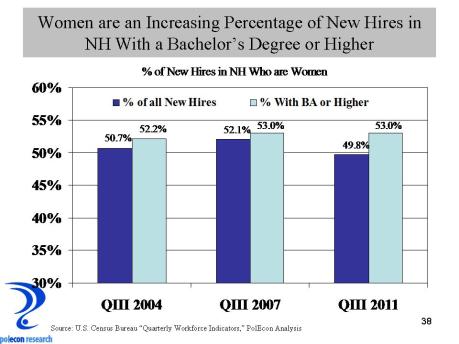

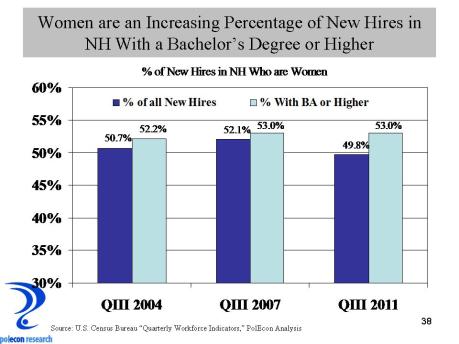

Nothing gets you thinking about gender equity issues more than being the father of three daughters, except maybe being the father of four or more daughters. In my upcoming October edition of “Trends Lines” I am looking at trends in NH’s labor force. One of the more significant trends is the increasing percentage of women employed at businesses in NH. Despite the fact that men participate in NH’s (and the nation’s) labor force at higher rates (about 9% higher in NH) than do women, women now are a slight majority of employees at businesses in NH. Women comprised 51% of employees covered by unemployment insurance during the third quarter of 2011 – the most recent data available. Only in Hillsborough and Sullivan Counties are men a majority (and by less than 1%) of employees at NH businesses.

Among workers with the highest level of educational attainment, those with a bachelor’s degree or higher, women comprise 52% of those employed by NH businesses. Moreover, the percentage of NH workers with the highest levels of educational attainment who are women is likely to increase because the percentage of new hires (not including recalls of layoffs), with at least a bachelors degree, who are women, is now even higher (53% – see chart below). These differences don’t seem large, but over time they have tremendous implications for the economy and for society.

I don’t know if this data says more about the changing nature of the workplace or the changing nature of the male workforce, but as the father of three daughters, my anecdotal experience leads me to believe it is more about the latter.

Categories: Demographics, Gender, Help Wanted, job growth, Labor, Recession

Tags: educational attainment, feminization, labor force, new hires, NH

Comments: 2 Comments

October 18, 2012

Two charts may tell an important story about New Hampshire’s labor market and perhaps trends in the economy. Help-wanted advertising has been rising in NH and as I’ve written before, it suggests job growth should be higher in NH based on the long-term relationship between help-wanted ads and employment growth in the state. A “skills gap” is one explanation for the divergence between help-wanted and job growth in NH, but I also offered that the divergence, along with trends in aggregate wage growth in NH may mean employment numbers will be revised upward. My money is still on an upward revision of job growth, with the skills gap playing an important role for some industries and occupations, because NH has more help-wanted ads per 100 individuals in the labor force than all but 10 states – job growth should be higher (chart below).

I would be more convinced of the skills gap being broadly responsible for slow growth in the state if a high percentage of help-wanted ads in New Hampshire were for the highest skill occupations (professional, technical, scientific and management), but as the chart below shows, NH ranks well down the list of states on the percentage of help-wanted advertising that is for the highest skill occupations. A skills gap could still exist between available jobs and available labor for occupations requiring specialized skills and training, even if they are not in professional, technical , or managerial occupations. Anecdotal evidence suggest many employers are having difficulty finding workers with the right skills. The skills gap demands further investigation, right now I am more concerned about what the relatively lower demand in NH for the highest skill occupations implies about our state’s economy.

Categories: employment, Help Wanted, job growth, Labor, NH Economy, Skills Gap

Tags: Economy, help-wanted, labor demand, NH, Skills gap

Comments: 1 Comment

October 16, 2012

I am not a political analyst and this is not a political blog. The polemics of political discourse are as tedious to me as the graphs I use with two Y axes are no doubt tedious to politicos. If you are prone to apoplexy or unable to view any data or information without an ideological lens, stop reading now.

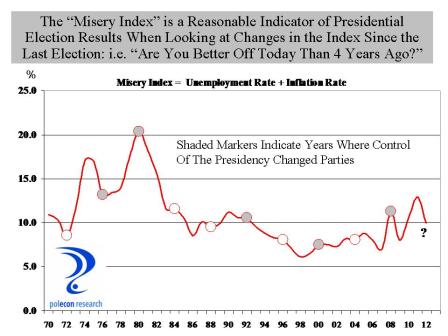

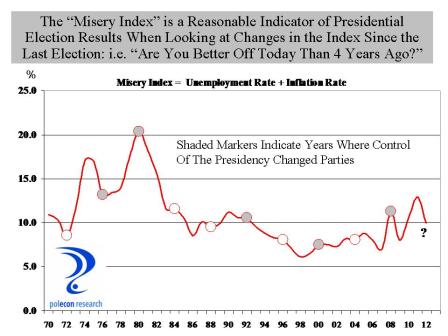

Since Ronald Reagan closed a presidential debate with Jimmy Carter by asking “are you better of today than you were four years ago” that question has been a benchmark in every presidential election and with good reason because the answer to the question is a pretty good predictor of election results. But how do you operationally define “better off”? The sum of the unemployment rate and the inflation rate is referred to as the “misery index”, since a high reading on either one or both of the components would likely have a negative impact on household sentiment. When the misery index is lower in an election year than it was in the previous presidential election, the party in power typically retains the presidency, and when the misery index is higher, the presidency typically changes parties. The chart below highlights the relationship. The chart line shows the value of the “misery index” in the 3rd quarter of each year (just before the election) and each circular marker indicates a presidential election year. The shaded markers indicate a change in control of the party in the White House.

With the exception of the 2000 election of George W. Bush over Al Gore, when the misery index was lower in an election year than it was in the prior presidential election year, the party in power retains the White House and when the misery index is higher, party control of the White House changes. The chart suggests that the 2012 election should be close, but probably leans toward President Obama’s reelection. Looking at the individual misery indices in swing states also gives The President a slight edge.

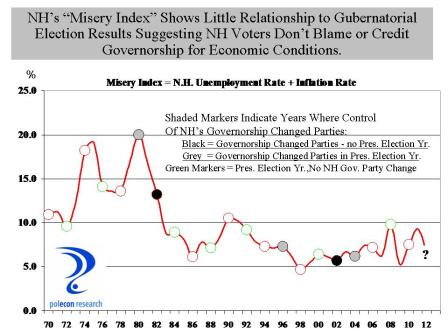

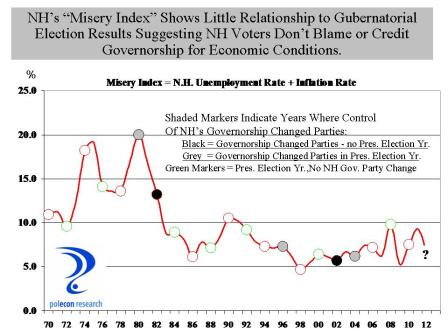

The misery index doesn’t say much about NH’s gubernatorial election however. The chart below shows that declines in the misery index (compared to 2 years earlier during the prior election for governor) do not appear to be associated with changes in party control of the governorship in the state. The chart does does show that a change is more likely to occur in a year in which the gubernatorial election coincides with the presidential election.

Overall, however, the chart suggests that NH voters do not hold gubernatorial candidates responsible for weaker economic conditions nor are they likely to credit them for good economic performance. Rather, they make their choices based on the perceived qualities of candidates. Isn’t that refreshing?

Categories: Election, employment, NH Economy, Politics, U,S, Economy, Unemployment

Tags: election, misery index, NH, obama, presidential election

Comments: 2 Comments