Unless I send-out email notifications about posts on this blog I don’t get a lot of readers. Either I don’t have much of anything interesting to post or people have more than enough to look at without needing another nerdy economic and policy blog to read. I’d put-up a poll to determine which is more responsible if I weren’t afraid of the results. Thanks to my web host (PureHost or “PureHell” as I have come to know it) any email that contains a link to my or another WordPress blog is filtered from outgoing or incoming email – thus no email notices to eager readers who just need a little prompting about the “can’t live without” information in this blog.

So while I spend another day with poor tech support trying to resolve the email foible, Ive decided to reprise a column (slightly shortened) that I wrote for Business New Hampshire Magazine after the November 2010 elections. It is a cautionary opine about the election results and in retrospect holds-up pretty well. I liked it in 2010 and I like it as much now – Business New Hampshire Magazine liked it so much that they stopped asking me to write a policy column shortly thereafter.

(From a January 2011 Column I Wrote for Business NH Magazine)

The Double-Edged Sword of Populism

“Mass movements can rise and spread without belief in a God, but never without belief in a devil.”

Eric Hoffer “The True Believer: Thoughts on the Nature of Mass Movements” (1951)

The tsunami that swept conservative Republicans into elective office this past November is due, in large part, to a mass movement called the Tea Party that shook the political ground and released seismic levels of populist energy in New Hampshire and across the country.

It’s a businesses community’s dream if the November election produces a public policy agenda of smaller government, lower taxes, and fewer regulations. The big government, more regulation, higher spending, and bailout policies of recent years are the “devil” that unified the Tea Party movement in New Hampshire and the nation and what makes the movement’s agenda attractive to many business leaders. But neither seismic nor populist energy is predictable, and neither has yet been effectively harnessed.

From its inception in 2009 through the November elections, what the Tea Party was against was more important to the business community than what the movement was for. As long as the business community and Tea Party populism share as their common “devil,” big government, more regulations and more spending, then their interests are generally aligned. But many, if not a majority in the loosely defined Tea Party movement have no love for much of the business world – big business, finance, insurance, and multi-national companies to name a few – they just happen to dislike President Obama and most Democrats more.

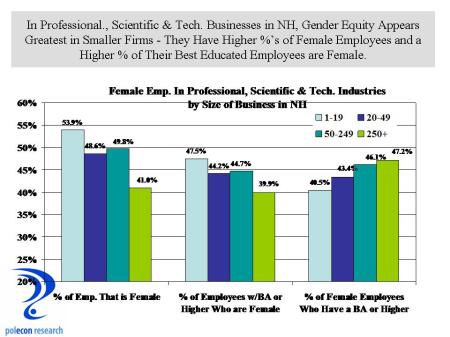

What “devil” will unify and sustain the populist movement after it has vanquished Democrats and/or big government? For businesses in New Hampshire, especially larger corporations, the stakes are large. The anti-immigration sympathies of Tea Party populists will clash with New Hampshire businesses increasing need to hire technology workers. The average educational attainment of foreign-born workers in New Hampshire is higher than that of its native-born population. About 45 percent of New Hampshire’s foreign-born residents have a bachelor’s degree or higher (the second highest of any state in the nation) compared to about one-third of native-born residents. Foreign born residents in New Hampshire make up an especially large percentage (32%) of al PhD’s and young workers age 25 to 34 with graduate degrees (24%). Thirty (30) percent of computer programmers in New Hampshire are foreign born as are 25 percent of the software engineers in the state.

Populist calls for protectionism and anti-globalization sentiments can also threaten what will be about $4 billion in exports by New Hampshire manufacturers in 2010, as well as the jobs that those sales support, up about 60 percent from $2.5 billion just since 2005,. In addition, the New Hampshire economy relies more on foreign direct investment than all but three states. In 2008, almost seven percent of workers in New Hampshire were employed by foreign-owned firms.

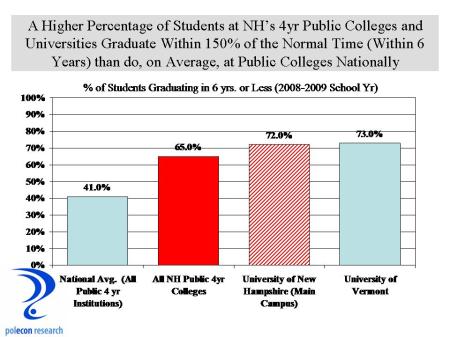

New Hampshire’s economic successes over the past several decades are the result of a transition to an innovation-dependent, technology-rich, economy that increasingly relies on workers with higher levels of educational attainment, across virtually all industries. Research and development, strong universities, high performing schools, attracting and retaining talented employees, and a reputation for being “ahead of the curve,” all support innovation. There are different ways policy makers can support or facilitate innovation but it is critical that they recognize its importance.

The recent election is sure to produce many spending, revenue, and regulatory policies in New Hampshire that will please most businesses. But at least a portion of the business community should be wary of becoming a unifying “devil” of the populist movement. Small business is off- the-hook and it is easy to see why. Most small businesses receive no loans, subsidies or other support from the government, and relatively few sell goods and services outside of the U.S. or hire any foreign-born workers. Moreover, most of the high-profile public policies that energize the populist movement have their greatest impacts and generate the largest costs for small businesses. Not all Americans love businesses or even capitalism, but they increasingly worship small business, according to one public opinion poll, small business is viewed more favorably by the public than are churches.

Big government is at the top of a short list of unifying ‘devils’ needed to sustain today’s populist movement, but “big” business isn’t far behind. While occasionally justified, in New Hampshire it would be unfortunate. New Hampshire is home to world-class, innovative businesses whose connections throughout the world benefit the state’s economy. Financial institutions in the state have avoided the practices that evoked populist outrage and their lending has been a key to the milder recession and stronger recovery of our state’s economy. Only about 100 New Hampshire businesses have more than 500 employees and only 260 have more than 250 employees, but combined they employ one-third of all workers in the state. That is far from a majority, but if a movement targets businesses employing one-third of New Hampshire’s workers, it is best described as something other than populist.