Natural gas prices have dropped sharply over the past two years and while the prospect of paying higher prices for energy is not appealing, unless prices rise soon, the prices we pay later are likely to be much higher and for much longer than currently forecast. The chart below shows the decline in natural gas prices over the past two years. In response, a steady rise in production of U.S. natural gas stagnated and began declining over the past year.

One impact of very low energy prices is a U.S. energy industry that is in financial shambles, devastating industries that support oil and gas extraction and threatening the financial institutions that lend to energy-related industries along the way. In the first quarter of 2016 the largest shale gas producer in the world had negative cash from operations. Most other large producers similarly had revenues from the sale of oil and gas that didn’t cover operating costs much less capital expenditures like drilling and completion. Sympathy for energy companies isn’t expected and won’t be forthcoming but the result of consistently low energy prices is predictable, lower U.S. oil and gas production. The longer prices for natural gas remain very low, and the smaller and financially weaker the industry gets, the less likely production will be able to ramp-up as prices rise (as they most surely will) and that means even higher prices in the future and for a longer period of time.

The Importance of Shale Gas

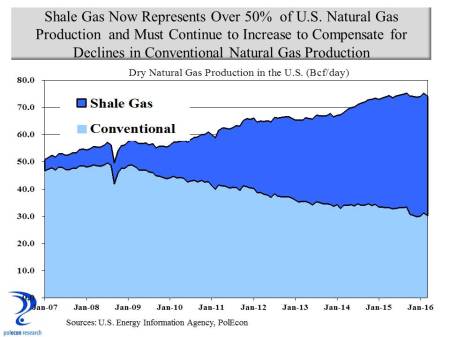

The U.S. is increasingly dependent on shale gas. Conventional natural gas production appears to be in terminal decline as fewer producers are drilling those wells. Shale gas now represents more than half of all natural gas produced in the U.S. (and rising). Production of shale gas will have to continue to increase just to compensate for the decline in the production of conventional natural gas but recently shale gas production has also begun to decline.

The Marcellus and Utica shale gas regions (closest to NH) are relatively new sources of shale gas (production began in the mid-2000s). They, Marcellus in particular, are the kings of shale gas in the U.S.. Not surprisingly they have, on average, the lowest cost-of- production of any shale gas region in the country. As a result, production in those regions has been maximized and the percentage of U.S. shale gas that comes from the Marcellus and Utica shales is now almost 50 percent. That percentage probably would be even higher except for pipeline capacity that limits movement of gas from the region.

But even in these lower cost-of-production regions the lowest cost producers have a breakeven price of about $3.50-$4.00/MMBTU (the average of all producers in the regions is higher). Meanwhile natural gas prices in the U.S. have been below $3.00 since 2015 and below $2.00 in 2016. The average production costs in shale regions that have been producing longer is considerably higher (from about $5.00/MMBTU to more than $6.50). The impact of natural gas prices on the production of increasingly important shale gas is best understood by looking at the impact that prices have had on different shale gas producing regions across the country. The chart below shows changes in production from each shale play’s peak production to May of 2016, when spot natural gas prices were at $1.92/MMBTU. As economics would predict, the chart shows that production declines were greatest in the highest production cost regions and smallest in the lowest cost Marcellus and Utica Shale regions. On a percentage basis declines in production appear even more dramatic. Production has declined 50 percent in the Haynesville shale region of Louisiana and Texas since peak production occurred there in 2012. The Barnett (Texas) and Fayetteville (Arkansas) shale regions experienced production declines of 39 and 26 percent respectively since 2012. In contrast the lower cost Marcellus (0.4%) and Utica (2.0%) experienced minimal declines in production and only in 2016 when spot prices were under $2.00/MMBTU.

But here is the thing, like all gas and oil producing regions, the longer the Marcellus and Utica shales produce gas the more likely production cost will rise as increased withdrawals require production to move from core areas of the shale play to more marginal areas of production.

Prices and Costs Matter

Only in a fantasy world will U.S. production of natural gas continue to increase for decades with prices remaining near or below breakeven costs. In the real world prices and costs matter. I am a fan of natural gas and believe increasing availability in New England will benefit consumers and businesses but thinking that natural gas can be simultaneously cheap, abundant, and profitable defies the rules economics.

Unfortunately I think the U.S. Energy Information Agency is contributing to a fantasy by suggesting an almost unlimited supply of natural gas at low prices in their forecast of natural gas production and prices contained in the EIA’s 2016 Annual Energy Outlook (released in May). I respect the work of the EIA and regularly rely on the data they produce but this forecast seems to lack a fundamental grounding in economics.

At $6.00/MMBTU (in 2015 dollars)the U.S. will have an ample supply of natural gas for decades. At $5.00 (not reached until 2024 in the EIA forecast scenario) production is unlikely to increase by 50 percent as the EIA forecast suggest. At prices below $3.00 for long, as is the current case, production will decline significantly and supply shortfalls will require supplementing U.S. production with ever larger withdrawals from storage, increasing imports (questionable if that is possible) and/or a reconsideration of the exporting of natural gas. It is important to note that shortfalls in production don’t mean there won’t be enough natural gas, there is ample gas in storage to cover shortfalls for a while but prices will rise quickly as more gas is withdrawn from storage. Rising prices should prompt increases in production but things may be different this time, depending on how soon prices rise. The industry is smaller, financially weakened, and unlike a few years ago capital, as well as workers who were forced to leave the industry as it shrank, may not be as readily available to ramp up production as prices rise.

As we know too well from experience, natural gas supply shortfalls have more dramatic and especially harmful impacts on New England. New Hampshire and the rest of the country would be better off with a modest rise in natural gas prices now rather than face supply shortfalls and much higher prices in future years.