A Simpler But No Less Troubling Explanation for Job Growth Trends

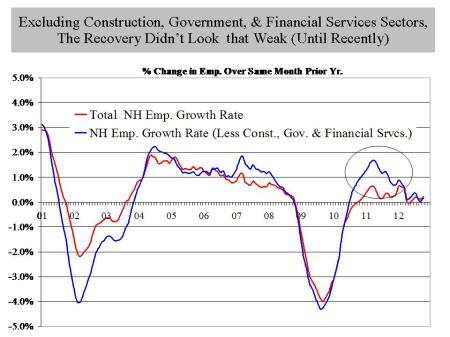

A lot of analysts, me included, have been looking for reasons why employment growth has been slower much of this recovery. That prompts questions about whether the slow recovery from recession is the result of cyclical factors (related to swings in the business cycle) or structural factors that fundamentally and longer-term alter the ability of NH and the nation to create jobs. While some wait for cyclical factors to improve job growth, in NH there is a lot of talk about demographics, migration, and too often (by me at least) the skills gap or mismatch between job openings and the skills of job seekers. Much of the demographic story, especially concerns about NH’s ability to attract people from other states, is relevant – except perhaps for the overblown concerns about NH’s “aging” (more about that in future posts). I believe demographics and things like the skills gap play an important role in the slow recovery and more general downward trend in job growth, both before and following the recession. But today, I offer another, simpler thesis, but one that may be no less troubling. If you look at job growth trends in NH by industry, you see that since the recession, employment weakness has really been most concentrated in three sectors of the economy; construction, government, and financial services. The chart below shows job growth trends over the past several years for total non-agricultural employment in NH, as well as total employment minus construction, government, and financial services. Absent the three hardest hit sectors of the economy, job growth following the recession (until recently that is) didn’t look that much different than the recovery from the briefer, milder recession of the early part of the last decade.

I know construction, government, and financial services are important but they still represent just over 20 percent of employment in the state, so the weakness in employment isn’t as broad-based as pessimists (including me at times) suggest. But what is more troubling is that the weakness in these sectors are more structural than cyclical and thus we may be waiting for a rebound that may never occur. I don’t think that is true for construction, where at least some rebound will occur as the housing market improves, as business investment strengthens, and whenever the fiscal health of governments improve enough for infrastructure spending to pick up. But weakness in government and financial services employment is likely more structural. New financial services regulations are likely to be an impediment to job growth in that industry for some time and there is no end in site for the budgetary impediments that will likely continue to weigh on job growth in the government sector. I, and others, will continue to look at the implications of such things as demographics and skills gaps on recent and prospective job growth, but we can’t fail to recognize that sometimes answers are less complex than the questions.

Explore posts in the same categories: employment, job growth, NH EconomyTags: construction, economic recovery, Financial services, government, job growth, NH, recession

You can comment below, or link to this permanent URL from your own site.

Leave a comment