The Home Price Rebound That Wasn’t

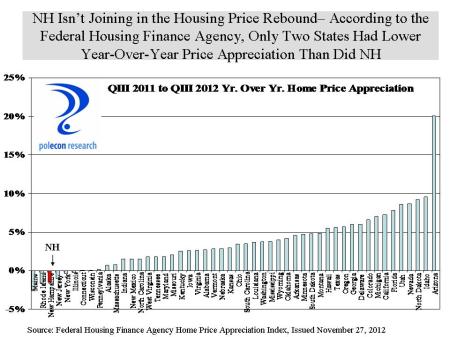

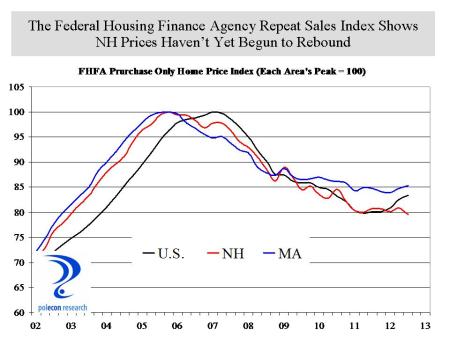

The Federal Housing Finance Agency released its latest home price appreciation index on Tuesday and while the data support the belief that housing is bouncing back across the country, and is now becoming a positive influence on economic activity rather than a drag, the news is not good for New Hampshire. The FHFA’ s repeat sales home price index shows that NH is one of only a few states that had price depreciation between the third quarter of 2011 and the third quarter of 2012 and only two states (Maine and Rhodes Island) had lower appreciation rates than did New Hampshire.

Repeat sales indices are the only accurate way to measure changes in home prices. Simply examining median sales prices doesn’t account for the fact that the characteristics of the houses sold may be different (location, size, type, etc.) unless the repeat sales method is used. I am by nature an optimist. I am rooting for the housing market because its rebound is important for the prospects of the NH economy and its not so bad for my balance sheet either. I am also not looking for yet another reason for realtors to take exception to some of my analyses. I am, however, a believer in the wisdom of markets (most of the time) but a lot of what happens in markets is driven by pure stupidity – or, rather, inattention, misinformation about fundamentals, and an exaggerated focus on currently circulating stories (the housing market is back, Mitt Romney has got the momentum in the swing states). At least one of those stories is true , the housing market is coming back as a whole in the nation, just not everywhere.

Tags: appreciation, home prices, home sales, Housing, job growth, NH, population growth

You can comment below, or link to this permanent URL from your own site.

December 13, 2012 at 2:23 pm

[…] growth, new household formations, and the need to replace old units – I’ve noted that before (and here). I wish people would look to job growth in NH instead of what is happening to home […]

January 2, 2013 at 9:28 am

[…] located in their state in November of 2012 than they had in November of 2011. As I have suggested before, NH’s job growth goes a long way toward explaining why the state’s housing market […]